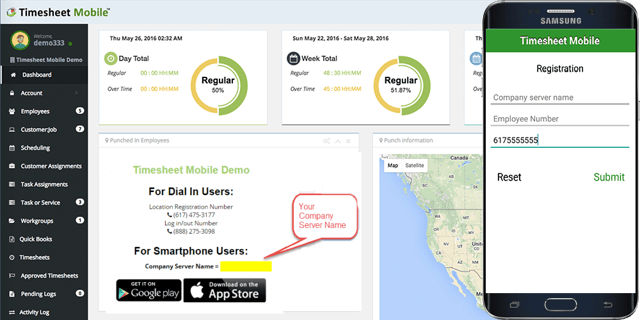

The best strategy to doing your taxes right is to start the process well in advance, either on your own or with the assistance of a professional accountant. Of course, the most important work takes place during the entire previous year, when you should be keeping meticulous records of your payroll costs and business expenses. Putting in place systems that assemble and organize those records for you, such as Timesheet Mobile’s time clock app, can make that work much simpler.

But whether or not you have been diligently preparing for tax season all year, there are a number of important last-minute things to consider before you file your return.

Double-check deductions

If you got your taxes done well in advance, congratulations! The hardest part is over and now you have the benefit of being able to double-check your work.

Go over every line of your filing and redo the math. Add up all of the deductions that you are claiming to make sure you didn’t leave something out or add something twice. Re-calculate the tax rate you owe to confirm that you aren’t overpaying or underpaying.

Take a few minutes and rack your brain for things you may have forgotten to consider. Was there a big equipment purchase early last year that you overlooked when compiling your deductions? What about your mileage costs? Do some research on deductions to see if there is something you may have missed.

Employee classifications

The IRS is on the lookout for businesses improperly listing employees as independent contractors. Before you classify a worker as a contractor, make sure that their relationship with your company matches up with the IRS’ definition of an independent contractor.

According to the federal government, there are a number of things to consider when classifying a service provider.

Do you control their schedule and are you able to make them work at a certain time? Does your company provide equipment or office space to the worker? Do you reimburse them for certain business expenses (travel, equipment)? Do you provide them benefits, such as a retirement plan, a health plan or paid time off? If the answer is yes, it’s highly likely that the worker must be classified as an employee; you are putting yourself at risk of an audit and stiff penalties if you do otherwise.

Keeping better track of the locations and hours of your on the clock employees will also help you avoid FLSA compliance issues all year round. Think of Timesheet Mobile as a payroll cheat sheet of sorts, helping you easily manage your workforce at-a-glance.

Separate business and personal expenses

If you’re a small business owner, it’s easier to get your personal and your business life mixed up. If your business is your passion, then that’s understandable most of the time. But during tax season, it’s of the utmost importance to try to keep them separate.

Look over the business deductions you’ve claimed and think about how you would justify all of them if you were audited. Were all of the expenses you’ve listed paid for using a separate, business-specific credit card or bank account? Is the “home office” that you’ve claimed truly only for business purposes and not simply a bedroom where you sometimes work?

Make sure that you’re not accidentally claiming the same deductions on your personal tax return as you are for your business. For instance, if you plan to deduct mortgage interest payments for both your home and your home office, you need to make sure that they are split up so that you’re not getting credit for your home office in both cases.

It’s not too late

If you decided to try to go it alone, there’s no shame in realizing now that the task was more complicated than you anticipated. There is definitely an accountant in the area who will jump at the opportunity to help you with some last-minute tax preparation. These businesses exist for this very reason and you have seven days to take advantage of that.

Professional tax preparers aren’t necessarily cheap, but they often more than make up for their fees by identifying tax savings that you wouldn’t have found on your own. Furthermore, even if you manage to do your taxes perfectly, the time and energy that you spent doing them might cost you and your business more than it would cost to outsource the task to a pro.

Filing an extension

Depending on how your business is structured, the IRS will give you five or six extra months to file your tax return as long as you submit a request for an extension by the deadline. For S and C corporations, the deadline is March 15, while for other types of partnerships the deadline is April 15.

If you are an S or C corporation, you should file Form 7004. If you are a sole proprietor and are reporting your business income on your personal tax return, then you need to file Form 4868 instead.

If you have any doubt about the accuracy of your return, then there’s no reason not to file the extension to look over it again.

However, getting an extension on preparing your tax return DOES NOT mean you have an extension on paying your taxes. If you owe any money to Uncle Sam, you must pay by the original deadline (March 15 or April 15). If you don’t pay the full amount by that time, you will be subject to late fees and interest charges that will grow the longer you don’t pay.

Therefore, even if you haven’t figured out exactly what you owe, it’s in your interest to make an educated guess and make a payment as soon as possible. Underpaying by a little bit is not nearly as bad as not paying at all, since the interest you owe on the late payment will not be as great.

Room for improvement?

Nobody likes paying taxes. But the good news is that the process of paying them provides you a great opportunity to scrutinize your finances and records and consider ways you could manage them better.

So once you’ve filed your taxes for this year, think about how you could make the process easier on yourself next year.

Some of the changes may be small things, like reminding yourself to not use your personal credit card for business lunches. Others may be larger, strategic decisions, such as shifting from a manual punch clock and paper-based system to an advanced employee time tracking system that will reduce the time and effort you spend organizing records.

Either way,  you take now will likely save you a headache next spring and allow you to focus your attention on building a stronger business.

you take now will likely save you a headache next spring and allow you to focus your attention on building a stronger business.